Sent from my iPhone

On Feb 19, 2016, at 9:38 AM, 'Ed Drannbauer' edrann@gmail.com [TSP_Strategy] <TSP_Strategy@yahoogroups.com> wrote:

Wow, what a jerk. Find a new doctor, and then report this one to Aetna and your state's insurance board for insurance fraud. It sounds to me he/she is clearly trying to rip off the insurance company by submitting a claim for something that gets a higher reimbursement than just a routine exam. Unfortunately for you, since you have the HDHP, the cost is passed to you than the insurance company.

People without a HDHP, would have just paid their co-pay, not question the coding at all, and the insurance company would have paid the higher costs not knowing it was only supposed to be a routine exam. If people are wondering why health care insurance costs keep going up and up, this is a prime example why.

Outside of going to court, I think you are stuck paying the bill for now though. You don't want the jerk to send the bill to a collection agency and ruin your credit. If you don't have enough funds in your HSA to cover it now, you can "pay yourself back" so to speak later in the year when you do. Make sure you keep all your receipts though. You'll probably have to submit them to PayFlex for reimbursement. BTW, I have the same Aetna HDHP also.

The extra fee for the eye exam sounds about right. The Aetna HDHP only covers a very basic eye exam (1950's style read from the eye chart exam), but most eye doctors probably recommend more than the basics (scan your eyeball, etc.).

From: TSP_Strategy@yahoogroups.com [mailto:TSP_Strategy@yahoogroups.com]

Sent: Friday, February 19, 2016 10:57 AM

To: TSP_Strategy@yahoogroups.com

Subject: Re: [TSP_Strategy] Health Plan Changes

mtndv8, thanks.

I guess I can ask for Dr.s notes from his office manager, but whom I ask for "coding review"? from Aetna?

His office manager bluntly told me her dr will not change coding and refuse to talk.

-----Original Message-----

From: mtndv8 mtndv8@yahoo.com [TSP_Strategy] <TSP_Strategy@yahoogroups.com>

To: TSP_Strategy <TSP_Strategy@yahoogroups.com>

Sent: Fri, Feb 19, 2016 10:40 am

Subject: Re: [TSP_Strategy] Health Plan Changes

Request a coding review.

Request the Dr's notes.

You are entitled to both. The notes should document your discussion of routine screening. If not, I'd consider another physician.

If you have the HDHP do you have an HSA account to cover the expense so it's pretaxed income?

This happened to me recently and has me thinking that there might be some discussion within the medical provider community about how the new health care coverages we've been encouraged to enroll in are billed.

My experience was for a routine colonoscopy screening that was coded diagnostic. The coding review found that the Dr who preformed the procedure changed the coding stating my personal physician had ordered the procedure. My Dr corrected this and the procedure was rebilled to my insurance.

Procedure was in June. I didn't get this worked out until January. Took me many days and didn't help that in Nov the hospital began the process of collections.

All said and done this "covered screening" cost me $289 (paid with HSA$) and much stress.

Good luck!

Maybe someone else here that can better speak to this...

Sent from my Verizon Wireless 4G LTE smartphone

-------- Original message --------

From: "Lindalyc@aol.com [TSP_Strategy]" <TSP_Strategy@yahoogroups.com>

Date: 2/19/2016 07:06 (GMT-07:00)

To: TSP_Strategy@yahoogroups.com

Subject: Re: [TSP_Strategy] Health Plan Changes

It's Health related topic but I think it's OK once in while in this investing forum.

I have this problem that I don't know how to deal with. and hope you can give me some pointers/suggestions.

I am with Aetna HDHP and I asked for routine eye exam as usual---no that I had or have any problem with my eyes, but Aetna policy says routine eye exam is 100% covered and I also received letter from dr's office reminding for annual routine exam.

I called for the routine exam and when I entered the office I also told them I was in for routine exam. As usual it's mostly Dr.'s assistant did all those exams, she only asked who my primary physician is and spent most of time entering data on computer. then Dr. came in for final check and asked about my diabetes ( I am on broadline diabete for more than 10 years) and any problem with eyes? I said no except the usual eye blurring (have been for 5 more years). then dr. said you're fine, no problem.

Then came the shock---Aetan pays nothing on this exam and I expect to pay out of pocket of $330 (deductible). Aetna said what my dr office submission was coded for medical diagnosis. I called dr's office and his manager said she didn't see routine box checked so it must not be routine and that I have diabetic problem. She said don't expect dr to change the coding and that she didn't want to talk about it any more and hung up the phone.

My husband, who doesn't have any medical problem, also went for routine eye exam at the same dr. office but by different dr.(I think he's the partner of my dr.), also end up pay $95--even he emphasized twice he want for routine check.

So the problem is not Aetna. It's not in the best interest of Aetna to help me to deal with Dr. because it would be glad not to pay anything expecting deductible from us. We've been with the same eye Dr. for many years for annual routine exams and Aetna paid most parts and we paid some small amounts <$50 for this and that extra exam Aetna said not within its policy. I was lazy to fight for those small amounts and ate them all.

But this time is really blowing out of water with $400+ out of pocket.

What should I do? any suggestion where to start to take actions?

Thanks in advance.

-----Original Message-----

From: sarah_oz@yahoo.com [TSP_Strategy] <TSP_Strategy@yahoogroups.com>

To: TSP_Strategy <TSP_Strategy@yahoogroups.com>

Sent: Fri, Feb 19, 2016 7:21 am

Subject: [TSP_Strategy] Health Plan Changes

Another Chance for Health Plan Changes

By Tammy Flanagan

February 18, 2016

Except under certain defined circumstances, such as marriage or the birth of a child, you're ordinarily not allowed to change your Federal Employee Health Benefits Program coverage outside of the annual open enrollment period. But this year, until the end of February, you may have such an opportunity.

It's all because of the new self plus one option that became available in 2016. The Office of Personnel Management has created a window to allow federal employees who are participating in premium conversion (the pre-tax deduction of health premiums from their paychecks) to change enrollment from self and family coverage to self plus one. (Since federal retirees do not participate in premium conversion, they can downsize their FEHBP coverage from self and family to self plus one or from self plus one to self only at any time.)

Many employees already have made the switch to self plus one when they had the opportunity to do so during last fall's open season. But if you missed out, it's not too late. This is the first time in FEHBP history there has been an enrollment option other than self only or self and family.

The self plus one option was intended to provide savings for a family of two people. But for some FEHBP plans, there won't be much difference in the cost of coverage -- and in a few cases, the new enrollment option actually is more expensive than self and family coverage. That might seem strange, but keep in mind that some FEHBP plans are more attractive to older retired couples who may have multiple chronic health problems and may also be filling expensive prescriptions on a monthly basis. Such expenses are factored in to the pricing of each option of every federal health plan. Plans that enroll those with significant health issues may have higher premiums than those that focus on preventative care or include more enrollees who are in good health.

The cost of a health plan is not necessarily a sign of its quality, but it could be an indication of the health of the enrollees who have chosen that plan. As the National Active and Retired Federal Employees Association recently reported:

As higher-cost options lose healthier enrollees and keep less healthy ones, higher claims for these plans cause premiums to rise. Such a system can precipitate "a race to the bottom," or what economists call adverse selection, where workers and annuitants are limited to plans with less coverage and smaller provider networks. However, the "Fair Share" formula's 75 percent cap on the government contribution toward any premium provides an important check against this race to the bottom. Absent the cap, the enrollee share of FEHBP premiums could be zero if enrollees select the lowest cost plans, giving enrollees a "premium-free" option.

Some federal employees may worry that moving from self and family to self plus one could end up costing them more out of pocket due to changes in deductibles and catastrophic protection limits. Savings in premiums don't always result in overall savings once out of pocket health care expenses are factored in. But I haven't found any differences yet in deductibles or catastrophic protection limits between self and family and self plus one plans.

For example, under the Blue Cross and Blue Shield Standard Option, the 2016 deductible is $350 per person. Under self plus one enrollment, both family members must meet the individual deductible. Under self and family, an individual can meet the deductible, or it can be satisfied when the total of family members' deductibles reaches $700.

Check your individual plan brochure to see if this is the case for your FEHBP plan.

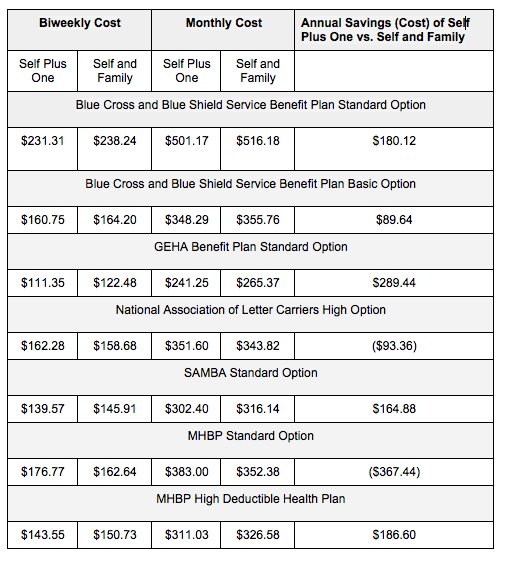

Here are a few examples of 2016 FEHBP plans, showing an overall comparison of self plus one and self and family coverage:

Until the end of February, all enrollment changes during the limited open enrollment period will be prospective to the first day of the first pay period following the one in which the change is requested. Contact your agency's human resources office for more help and information if you're interested in making the switch.

(Top image via piotr_pabijan / Shutterstock.com)

By Tammy Flanagan

February 18, 2016

Posted by: Michael Hines <surfgull@yahoo.com>

| Reply via web post | • | Reply to sender | • | Reply to group | • | Start a New Topic | • | Messages in this topic (6) |

Belum ada komentar untuk "Re: [TSP_Strategy] Health Plan Changes"

Post a Comment