Federal Retirees to Receive Biggest Cost-of-Living Bump Since 2012

October 13, 2017

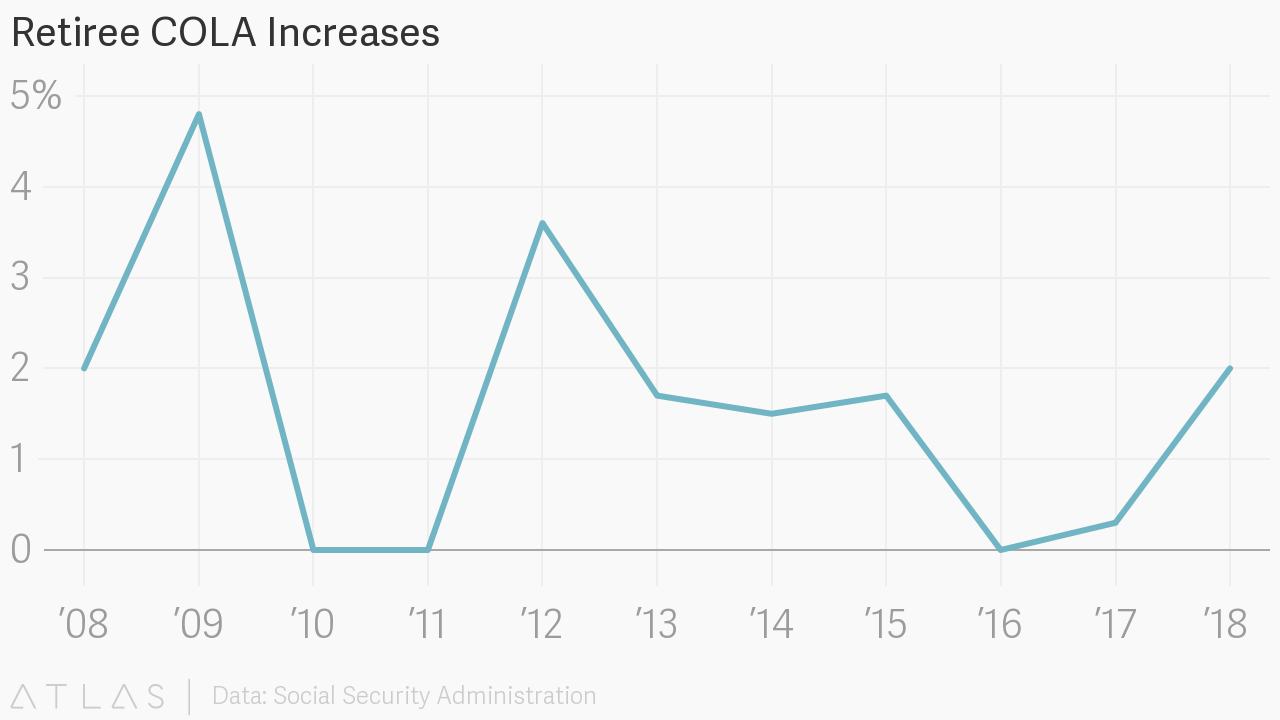

Federal retirees will receive a cost-of-living adjustment of 2 percent next year, the largest boost since 2012.

The increase—which applies to all retirees receiving Social Security benefits and not just federal retirees—was welcome news to retiree advocates, coming off two years of minimal or no growth. Federal retirees received a 0.3 percent adjustment this year, and no cost-of-living increase in 2016.

"Today's announcement was eagerly awaited by millions of Americans who rely on the increase to keep up with the rising prices for food, housing, gas and medical care," said Richard Thissen, president of the National Active and Retired Federal Employees Association, in a statement.

NARFE has long advocated, however, for a change in the way the COLA is calculated to better reflect how senior citizens spend their money.

The annual COLA is based on the percentage increase in the average Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter of the current year over the average CPI-W for the third quarter of the last year in which a COLA became effective. This year the average CPI-W for July, August and September was 239.668. The average for the third quarter of 2016 was 235.057.

If the percentage increase is less than 2 percent, then retirees under the Federal Employees Retirement System receive the full COLA (the same amount as Civil Service Retirement System retirees). If the change is 2 percent to 3 percent, FERS retirees receive 2 percent. And if the increase is 3 percent or higher, FERS retirees receive 1 percentage point less than the full increase.

NARFE would like to see the formula switched to use the Consumer Price Index for the elderly (CPI-E). "Our nation's seniors spend more than twice as much on medical care than the population measured by the current formula to calculate COLAs, the CPI-W," Thissen said. "Congress must act to implement a new formula that adequately measures costs incurred by seniors."

Thissen also noted that federal retirees' portion of health care premiums will rise by 6.1 percent next year, which significantly outpaces the 2 percent cost-of-living boost. "On top of this, Medicare premiums increased disproportionately for most federal annuitants during the last two years, and long-term care premiums sharply increased by 83 percent, on average," he stated. "A new a cost-of-living formula that doesn't force these Americans to take one step forward, then two steps back is long overdue."

The new COLA will take effect starting with December 2017 benefits. The following chart provides a look at COLAs over the past decade.

October 13, 2017

Posted by: sarah_oz@yahoo.com

| Reply via web post | • | Reply to sender | • | Reply to group | • | Start a New Topic | • | Messages in this topic (1) |

Belum ada komentar untuk "[TSP_Strategy] 2% COLA for Fed Retirees"

Post a Comment