![Re: [TSPStrategy] Rollover to IRA from TSP - Re: [TSPStrategy] Rollover to IRA from TSP -](http://2.bp.blogspot.com/-erTXCq61ULM/TmHYAQBZ0GI/AAAAAAAACCs/6cBX54Dn6Gs/s110-c/default.png)

Re: [TSPStrategy] Rollover to IRA from TSP -

![Re: [TSPStrategy] Rollover to IRA from TSP - Re: [TSPStrategy] Rollover to IRA from TSP -](http://2.bp.blogspot.com/-erTXCq61ULM/TmHYAQBZ0GI/AAAAAAAACCs/6cBX54Dn6Gs/s110-c/default.png)

Re: [TSPStrategy] Rollover to IRA from TSP -

'wait- where'd my pay raise go?? obummer demoncrat bunny puddin something something'

exquisitely pithy stuff from the village.io idiot...like eating just the white parts of an orange

Groups.io Links:

You receive all messages sent to this group.

View/Reply Online (#3488) | Reply To Group | Reply To Sender | Mute This Topic | New Topic

Your Subscription | Contact Group Owner | Unsubscribe [prefander.leadersworkshop@blogger.com]

Re: [TSPStrategy] Rollover to IRA from TSP -

Re: [TSPStrategy] Rollover to IRA from TSP -

Nothing kills an average like a zero.

On Thu, 29 Dec 2022 15:49:16 +0000 (UTC), "winfield100 via groups.io" <winfield100=yahoo.com@groups.io> wrote:

Anybody else notice the paltry, relative to inflation, "raise" we got the past few years? Note since the CPI Inflation is "Backward Looking" and the Base Pay Raise is denoted as for the coming year, but is based on the most recent year's inflation, I used the offset years as noted below as Base Pay Raise Year / CPI Inflation Year.

Year Base Pay Raise % CPI Inflation % % Increase in Pay Gap

23/22 4.1 7.7 88

22/21 2.2 7.5 241

21/20 1.0 2.5 150

20/19 2.6 1.7 -35

19/18 1.4 1.9 36

18/17 1.4 2.1 50 17/16 1.0 2.1 110

16/15 1.0 0.7 -30

15/14 1.0 0.8 -20

14/13 1.0 1.5 50

13/12 0.0 1.7 O-Bummer

12/11 0.0 3.0 Big O-Bummer

11/10 0.0 1.5 O-Bummer

10/09 1.5 2.7 80

09/08 2.9 3.8 31

08/07 2.5 4.1 64

07/06 2.2 3.23 47

Seems to me ol' Archie Bunker was more focused on helping his employees keep up with inflation than Bunny Herded President Puddin' or his old boss who for 3 years spit in our hand when we had it out.

On Wed, 28 Dec 2022 19:43:01 -0500, "winfield100 via groups.io" <winfield100=yahoo.com@groups.io> wrote:

I have none of my data from prior to the changeover to the new system

On Dec 28, 2022, at 7:22 PM, JOHN WATTS <johnnasa2035@outlook.com> wrote:

On Dec 26, 2022, at 1:43 PM, MD2018 via groups.io <rlkane.wc=verizon.net@groups.io> wrote:

My funds are still in TSP but was considering moving in the future to Vanguard. VG does give you move more fund types to choose from, but for comparison it looks like only the Index 500 at VG compares well with C fund. TSP wins in the other funds.VG 500 Index Admiral expense ratio is 0.04%(compares with C fund expense 0.042% + invest exp of 0.001%)VG Federal Money Market fund expense ratio is 0.11% (compares with G fund expense 0.043%)VG Extended Market Index expense ratio 0.34% (compares with S fund expense 0.043% + invest exp of 0.016%)VG Total Bond Fund Index expense ratio is 0.05% (compares with F fund expense 0.043%+ invest exp of 0.015%)On Monday, December 26, 2022 at 01:05:15 PM EST, Sherry Bauer <sherry.bauer@gmail.com> wrote:I was glad to see this reply from you. I've often thought the same thing. Once you deduct those fees from brokerage places, your earnings go down considerably. I've been retired for 10 years and wouldn't even think of moving my money out of TSP.On Mon, Dec 26, 2022, 10:40 AM Del Brett <bretdelman@msn.com> wrote:Been investing in TSP and lots of other places for years and you won't find a better deal than TSP in the long run for yearly fees and the other side of the TSP fence looks greener at times but its not! Would dare you to show its better other places with Proof lol not going to happen as no one beats the fees even though people try to say they do. Lots of new options are opening at TSP not saying they are a better deal. Nothing is different at TSP when you retire other than you don't add your own money. You are completely wrong on everything lol.

From: TSPStrategy@groups.io <TSPStrategy@groups.io> on behalf of ShaneBro via groups.io <s.guy75=yahoo.com@groups.io>

Sent: Thursday, December 22, 2022 8:54 AM

To: TSPStrategy@groups.io <TSPStrategy@groups.io>

Subject: Re: [TSPStrategy] Rollover to IRA from TSP -Once retired, TSP is an inefficient nightmare designed to make your life as complicated as possible. Its a roach motel with few options and they don't want U to leave and have better opportunities elsewhere.On Thursday, December 22, 2022 at 09:09:25 AM EST, Mermaid <mermaid99521@gmail.com> wrote:Looking into moving 401K out of TSP to a self directed IRA and I am surprised of the method of which the money is delivered to the brokerage.... by USPS. They will not even overnight the check. Simple USPS from what I am told when I call TSP support. Has anyone had experience with an in kind rollover to another brokerage. Thank you.

Re: [TSPStrategy] Rollover to IRA from TSP -

Nothing kills an average like a zero.

![Re: [TSPStrategy] Rollover to IRA from TSP - Re: [TSPStrategy] Rollover to IRA from TSP -](http://2.bp.blogspot.com/-erTXCq61ULM/TmHYAQBZ0GI/AAAAAAAACCs/6cBX54Dn6Gs/s110-c/default.png)

Re: [TSPStrategy] Rollover to IRA from TSP -

Dave is correct Del Brett...the TSP, in particular the G Fund I believe, is the funding source of last resort. When the debt limit gets reached and the Treasury Secretary starts talking in terms of "...extraordinary measures..." it means the Treasury Secretary is literally raiding the TSP to fund daily operations.

I had a previous employer who set up a false 401K account, even brought in a local brokerage to sell investing in it to us (no matching which is why I didn't participate but a lot of others did). The money people had been putting in their "401Ks" had just been put in a bank account, the brokerage had never had 401K funds placed with them. The company had even created false statements to make it look like people had money in the brokerage! When the company's Venture Capital funds ran out the false accounts were used to pay the first few people to get to the bank their last paychecks. Out of a company of 95 people only about a dozen got their last paychecks paid. They owed me $10K in pay, vacation, and travel expenses. I rode my motorcycle down the Boulder Pearl Street Pedestrian Mall straight to the bank and was the first one there to cash my check. I stood there and watched people literally come in and get their cash until the teller started telling people the account had been depleted! The CFO ended up wearing Federal Camper Inmate Green. THAT was my final straw which drove me to go to work for the people that print the money!

I doubt we'll ever see Janet bunking with Martha!

As for TSP, when I retire, I plan on pulling all of it out, putting it all in my E-Trade and Schwab IRA and Roth accounts, and investing in a class of high-dividend paying stocks known as BDCs (Business Development Corporations...research them...there are only about 3 dozen of them and they are the best kept investing secret I know of). The fees for ETFs are so high they actually degrade the value of the ETF over time and Mutual Fund returns typically can't compare to BDCs.

If you live in a state like Oregon (I used to...lived in Hillsboro...worked for Mama Tek...hung out at Dr. Feelgood's) just get the hell out after retiring but before withdrawing.

The ONLY reason I'm still investing in the TSP right now is I can put almost 3.5 times more money in my TSP Roth account than I can in a privately managed Roth.

On Tue, 27 Dec 2022 19:23:53 -0800, "Dave in Dallas" <datruedave+GroupsIO@gmail.com> wrote:

On Tue, Dec 27, 2022 at 11:35 AM, Del Brett wrote:TSP has very little to do with the Federal Government, in my opinion! Not like the government can get money out of TSP like government tax money we all pay in.Wait, are you trying to say that the federal government hasn't borrowed money from the TSP already? Didn't it do that in 2017 and 2021? Sure, the accounting was maintained and investors made whole, but to say the government can't do it is a bit naive (and wildly inaccurate).

Groups.io Links:

You receive all messages sent to this group.

View/Reply Online (#3483) | Reply To Group | Reply To Sender | Mute This Topic | New Topic

Your Subscription | Contact Group Owner | Unsubscribe [prefander.leadersworkshop@blogger.com]

Re: [TSPStrategy] Rollover to IRA from TSP -

Let me append that last message. They have *summary info* going back to 2010. From the main page, click on "Account Summary", then "Account Balance History" at the top.

Bruce

It looks like they now have history going back to 2010 on the site.

Happy New Year everyone,

Bruce

On 12/28/2022 7:22 PM, JOHN WATTS wrote:

The new system is horrible.

When the new system was first stood up I went online to pull up my past 12 months of inter-fund transfer history. To my SHOCK this information was not and is not available. Two months ago the same problem existed - no historical data.

(Over the past 12 months I slowly moved funds for the equity funds to the G Fund. I would like to monitor my re-entry price points.)

In response to the lack of data I called and spoke with a representative. I was told that TSP would send me the data I requested on my account. Months later I am still waiting for the data.

If this crappy service happened at Wells Fargo you know that some congressional committee would demand a solution from the bank leadership.

Has any one else had a similar experience?????

On Dec 26, 2022, at 1:43 PM, MD2018 via groups.io <rlkane.wc=verizon.net@groups.io> wrote:

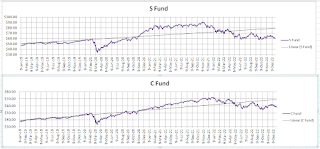

My funds are still in TSP but was considering moving in the future to Vanguard. VG does give you move more fund types to choose from, but for comparison it looks like only the Index 500 at VG compares well with C fund. TSP wins in the other funds.

VG 500 Index Admiral expense ratio is 0.04%(compares with C fund expense 0.042% + invest exp of 0.001%)VG Federal Money Market fund expense ratio is 0.11% (compares with G fund expense 0.043%)VG Extended Market Index expense ratio 0.34% (compares with S fund expense 0.043% + invest exp of 0.016%)VG Total Bond Fund Index expense ratio is 0.05% (compares with F fund expense 0.043%+ invest exp of 0.015%)

On Monday, December 26, 2022 at 01:05:15 PM EST, Sherry Bauer <sherry.bauer@gmail.com> wrote:

I was glad to see this reply from you. I've often thought the same thing. Once you deduct those fees from brokerage places, your earnings go down considerably. I've been retired for 10 years and wouldn't even think of moving my money out of TSP.

On Mon, Dec 26, 2022, 10:40 AM Del Brett <bretdelman@msn.com> wrote:

Been investing in TSP and lots of other places for years and you won't find a better deal than TSP in the long run for yearly fees and the other side of the TSP fence looks greener at times but its not! Would dare you to show its better other places with Proof lol not going to happen as no one beats the fees even though people try to say they do. Lots of new options are opening at TSP not saying they are a better deal. Nothing is different at TSP when you retire other than you don't add your own money. You are completely wrong on everything lol.

From: TSPStrategy@groups.io <TSPStrategy@groups.io> on behalf of ShaneBro via groups.io <s.guy75=yahoo.com@groups.io>

Sent: Thursday, December 22, 2022 8:54 AM

To: TSPStrategy@groups.io <TSPStrategy@groups.io>

Subject: Re: [TSPStrategy] Rollover to IRA from TSP -Once retired, TSP is an inefficient nightmare designed to make your life as complicated as possible. Its a roach motel with few options and they don't want U to leave and have better opportunities elsewhere.

On Thursday, December 22, 2022 at 09:09:25 AM EST, Mermaid <mermaid99521@gmail.com> wrote:

Looking into moving 401K out of TSP to a self directed IRA and I am surprised of the method of which the money is delivered to the brokerage.... by USPS. They will not even overnight the check. Simple USPS from what I am told when I call TSP support. Has anyone had experience with an in kind rollover to another brokerage. Thank you.