Hi,

I am always going to be bullish since I have 15 years to retire but several months ago I started paying more attention to the markets in order to preserve gains and be defensive when the markets are trending down. Currently I am still 50S/50C, but this Friday's loss has me on my toes. These next two weeks or maybe till end of election has me scrambling on trying to find my comfort zone and signal if I should move to G or F in case of market down trend.

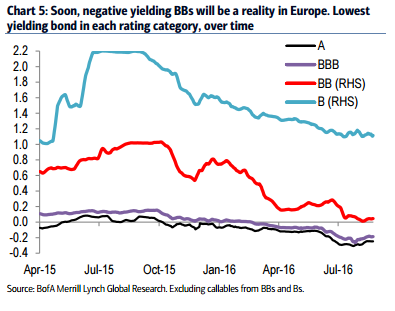

These are articles have me thinking when Friday's market went down after being sideways for Jul-Aug (see chart).

How Concerning Was Friday's Sell-Off?

What Happened To The Market Today? $SPY

What Happened To The Market Today?

The S&P 500 Is Headed For A Major Drop $SPY

The S&P 500 Is Headed For A Major Drop

This Stock Indicator Hasn't Been This High Since the Start of the Last Bear Market

Since downtrends usually come fast more than uptrends, I believe it's good to know an exit point to G just in case. Right now I am keeping an eye out on he trend.

We ended at 2,127, below article has some suggestions on the downtrend.

Daily State Of The Markets: Are The Bears Finally Ready? $SPY

http://www.seekingalpha.com/article/4004318

Hope this helps some of you in learning more or just being aware of your future.

Roman

Posted by: romansmr2@yahoo.com

| Reply via web post | • | Reply to sender | • | Reply to group | • | Start a New Topic | • | Messages in this topic (1) |

Belum ada komentar untuk "[TSP_Strategy] Preparing for a Bearish Run????"

Post a Comment