An Open Season checklist for active federal employees

Tips for saving money on health care and to help guide you through the process of choosing a plan in the Federal Employees Health Benefits Program.

Next year, federal employees will face higher health plan premiums, fewer choices, and big benefit changes. As FEHB Open Season starts, here's a checklist to guide you through the process of choosing a plan, plus tips on how to save money on health care costs.

Confirm Available Plans

First, find out which plans you can enroll in. There are 156 FEHB plans available in 2024, far fewer than the 271 in 2023. The main reason for the drop is Humana's departure from FEHB, but NALC Value, Indiana University Health Plan, and AultCare also won't be available next year.

HMO service area changes could also alter plan availability. Counties can be added or subtracted from a plan service area from year to year. For example, Kaiser plans in Colorado have significant service area changes as they have both added and subtracted counties.

There aren't very many new plans next year. Compass Rose now has two options, high and standard, and they've also added a new agency with enrollment eligibility for those plans, the Veterans Affairs Department. Sentara Health has added a plan in Northern Virginia.

Review Section 2 of the FEHB Plan Brochure

The official plan brochure is an invaluable source of information on how your FEHB plan works. However, each brochure often has more than 100 pages, which can be overwhelming. The one thing you should check every Open Season is section 2, "Changes for 2024." Here, the plan will alert you to important benefit changes like a cost share increase for a service, new preauthorization requirements, or new benefits for the upcoming year. Plan brochures can be found on the plan website, OPM plan comparison tool, and Checkbook's Guide to Health Plans.

Here are examples of some 2024 changes:

- MetLife dental and vision plans will offer complimentary identity and fraud protection

- SAMBA plans have added doula coverage

- BCBS plans have added family and marital counseling

- APWU is switching provider networks from CIGNA to UnitedHealthcare

- UnitedHealthcare Choice Plus Advanced is doubling the catastrophic maximum from $3,000 to $6,000 for self-only enrollees and from $6,000 to $12,000 for self-plus-one and self & family enrollees

Importantly, 2024 will see improved fertility benefits for federal employees. All FEHB plans must now cover artificial insemination procedures and fertility drugs associated with AI and IVF procedures. Section 2 will notify you of these changes, and you should also carefully read the reproductive services part of the plan brochure found in section 5(a).

One national PPO plan with open enrollment, BCBS Standard, has added a significant new benefit for 2024—a $25,000 annual maximum for assisted reproductive technologies which includes IVF. Covered AI procedures and fertility drugs do not count toward the $25,000 maximum. Keep in mind you'll still pay 15% for ART services when using preferred providers, and BCBS Standard has the highest premiums of any national PPO plan.

Use Yearly Cost Estimates to Narrow Down Plans

While important, and a for-sure expense, selecting an FEHB plan on premium alone ignores what you'll pay when using covered services and the impact of a plan contributing to a health savings or reimbursement account.

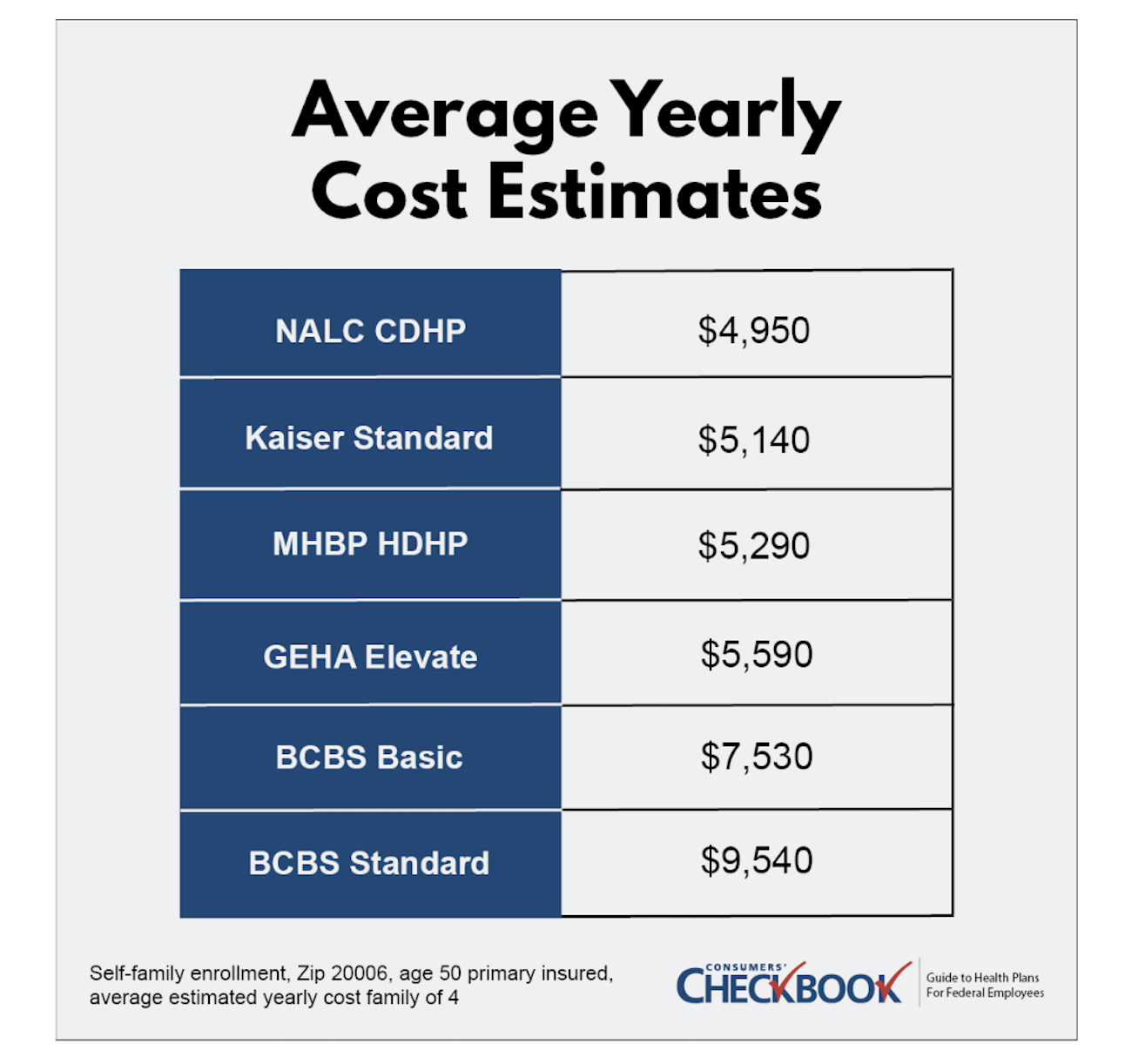

For 45 years Checkbook's Guide to Health Plans for Federal Employees has ranked plans on estimated total cost based on user information—age, family size, and expected healthcare usage. The benchmark ranking shows big price differences among plans.

For example, a family of four in the Washington, D.C., area with age 50 primary insured and average healthcare expenses could save $4,590 in estimated costs switching from BCBS Standard to NALC CDHP.

Check Providers and Prescription Drugs

These are the last two steps before enrolling in your FEHB plan, and they impact both the cost and care you'll receive. If you have existing providers, you'll want to check how they're covered by the plan. You always pay less by staying in-network, and you can't assume the providers will remain unchanged from one year to the next. You can find a provider directory on the plan website.

Similarly, for any current medications you take, you'll want to check to see if they're covered. Many FEHB plan websites will have prescription drug cost tools where you'll be able to select your drug, dosage, and preferred pharmacy. Again, you can't assume there won't be any prescription drug changes in your current plan from one plan year to the next.

Take Advantage of Tax Preferred Savings Accounts

With a 7.7% increase in the average enrollee share of FEHB premiums for 2024, federal employees should be looking for ways to save money on healthcare expenses.

Only about 20% of federal employees use a flexible spending account, but that number should be 100% as all federal employees will have some predictable healthcare expenses—dental care, vision care, planned medical visits, prescription drug refills, or over-the-counter pharmacy items. Through funding from payroll contributions before taxes, paying for approved healthcare expenses with the FSA will save you about 30%.

Employees can contribute up to $3,050, but you must be somewhat careful in budgeting as only $610 of unused funds can be rolled over into a new plan year. Employees with an HSA aren't allowed to have a healthcare FSA, but they can still set up a limited expense FSA for dental and vision expenses, which is a good idea to help keep HSA funds invested. You must renew your enrollment every Open Season to keep your FSA. You can enroll and learn more at FSAFEDS.

HSAs offered by high deductible plans offer federal employees an even greater opportunity to save for both immediate and future healthcare expenses. HSA contribution limits are increasing in 2024 to $4,150 for self-only enrollees and $8,300 for self-plus-one and self & family enrollments. HDHPs fund the HSA with a monthly premium pass-through that varies by plan and ranges between $750 to $1,200 for self-only enrollees and $1,500 for $2,400 for self-plus-one and self & family enrollments. Voluntary contributions are triple tax advantaged—they go in tax-free, grow tax-free, and if withdrawn for a qualified healthcare expense, exit tax-free. Once you turn 65, you can make non-medical distributions from the HSA and only pay your normal tax obligations.

FSA and HSA eligibility ends once you retire and have Medicare.

The Final Word

Only about 5% of federal employees switch health plans every year. If you've kept the same one for many years, now is the time to see if there might be a plan that offers better value with equal or better coverage.

Following this Open Season checklist will point you in the right direction:

- Understand what plans are available to you

- Check section 2 of the FEHB plan brochure to stay up-to-date of important plan benefit changes

- Use yearly cost estimates to find plans that offer the best value

- Research your providers and prescription drugs before enrolling in a plan

Also, don't forget to take advantage of tax-preferred savings accounts to save money next year. Both the FSA and HSA can provide substantial savings on health care expenses.

Kevin Moss is a senior editor with Consumers' Checkbook. Checkbook's 2024 Guide to Health Plans for Federal Employees is available now. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.

Groups.io Links:

You receive all messages sent to this group.

View/Reply Online (#3739) | Reply To Group | Reply To Sender | Mute This Topic | New Topic

Your Subscription | Contact Group Owner | Unsubscribe [prefander.leadersworkshop@blogger.com]

Belum ada komentar untuk "[TSPStrategy] An Open Season checklist for active federal employees"

Post a Comment