Health Insurance Options for Veterans

There are lots of choices, especially for those who have joined the civilian federal workforce.

As we continue to celebrate National Veterans and Military Families Month, I remember a quote by President Obama: "It's about how we treat our veterans every single day of the year. It's about making sure they have the care they need and the benefits that they've earned when they come home."

According to a 2021 Interagency Veterans Advisory Council report, about 500,000 military service veterans currently work as civilian federal employees across government. Retired service members who are currently employed or retired from federal civilian employment get a special set of health benefits.

Retired military members are typically eligible for TRICARE health insurance. Other former service members are generally not, with one notable exception: Medal of Honor recipients and their families. Benefits for the reserve component are somewhat harder to navigate because eligibility rules and plan options are based on the military member's service status, which can change multiple times throughout their career.

There are two main types of TRICARE beneficiaries: sponsors (active duty, retired, and Guard and Reserve members) and family members (spouses and children registered in the Defense Enrollment Eligibility Reporting System). Unmarried biological children, adopted children and stepchildren are eligible for TRICARE until age 21 (or 23 if in college). TRICARE covers almost 10 million current and former military members and their dependents.

According to the Military Benefit Association, there are the following types of TRICARE benefits available to retired service members and their families:

- TRICARE Prime (in certain U.S. areas)

- TRICARE Select (across the U.S.)

- TRICARE Select Overseas

- U.S. Family Health Plan (in specific U.S. locations)

- TRICARE For Life (with Medicare Parts A and B)

These plans offer generous coverage for medical care and prescriptions with relatively low out-of-pocket costs. TRICARE has health maintenance organization and preferred provider options. Health benefits advisers are available to provide information about the plans to authorized personnel and beneficiaries.

TRICARE and FEHB

The option of using TRICARE, the Federal Employees Health Benefits program or both is available to federal employees who are TRICARE-eligible. If you're covered by both TRICARE and FEHB, the FEHB plan will pay first and TRICARE will be the secondary payer. If you are employed and also enrolled in Medicare, then the primary payer will be FEHB with Medicare as secondary payer. TRICARE pays last.

If you're enrolled in an FEHB plan on the date of your retirement from federal civilian employment, you can continue FEHB coverage into retirement. Once retired, you can suspend your FEHB coverage, but can cancel the suspension during any future open season period. See information below regarding suspending FEHB coverage in retirement. TRICARE coverage qualifies under the five-year test to continue FEHB coverage in retirement as long as you're enrolled in an FEHB plan on the date of retirement.

TRICARE for Life and Medicare

TRICARE For Life is Medicare-wraparound coverage if you're TRICARE-eligible and have Medicare Part A and B. You can get health care services from Medicare-participating and non-participating providers, as well as from providers who have opted out of Medicare.

As the primary payer, Medicare approves health care services for payment. If Medicare does not pay because it determines that the care is not medically necessary, TFL also does not pay. You can appeal Medicare's decision and if Medicare reconsiders and provides coverage, TFL also reconsiders coverage. If a health care service is covered by both Medicare and TFL, but Medicare won't pay because you have used up your Medicare benefit, TFL becomes the primary payer. In this case, you're responsible for your TFL deductible and cost shares.

If TFL is the primary payer, you must visit TRICARE-authorized providers and facilities. You'll have significant out-of-pocket expenses when you get care from opt-out providers. Veterans Affairs providers can't bill Medicare and Medicare can't pay for services received from VA. If you're eligible for both TFL and VA benefits, you'll have significant out-of-pocket expenses when seeing a VA provider for health care not related to a service-connected injury or illness. To learn more about TFL benefits and coordination with Medicare, see the TFL Handbook.

Federal employees who reach age 65 before retirement can use one of the FEHB plans and wait to enroll in TFL and Medicare Part B at retirement using the Special Enrollment Period for Part B. If you choose to delay enrollment in Part B and rely solely on your employer-sponsored coverage, sign up for Part B before you retire or during your Special Enrollment Period. Your TFL coverage begins on the first day you have both Medicare Part A and Part B coverage.

Other Health Insurance

If you have any health insurance other than TRICARE, it is called "other health insurance" or OHI. This can be Medicare or an employer-sponsored health insurance such as FEHB. By law, TRICARE pays after all other health insurance, other than a few exceptions such as Medicaid or TRICARE supplements. This means your OHI processes your claim first. Then, you or your doctor files your claim with TRICARE.

FEHB Open Season

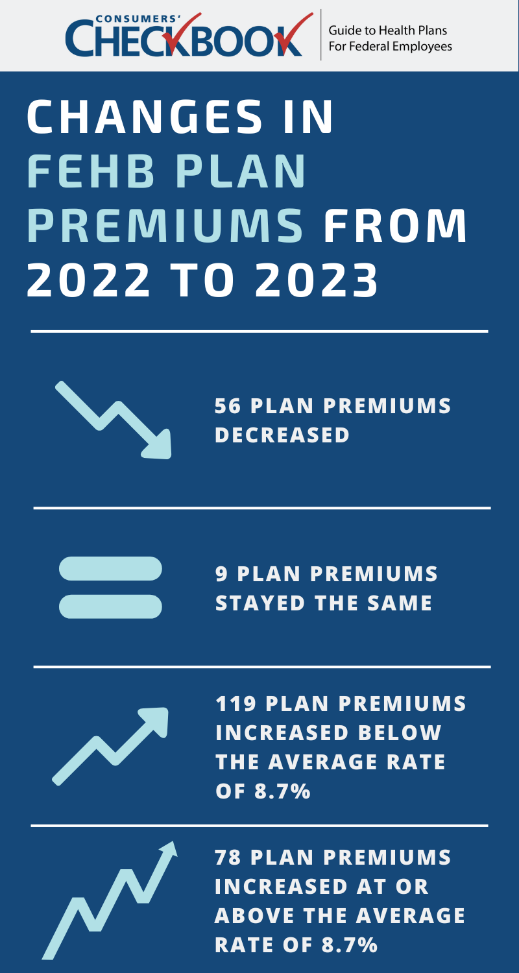

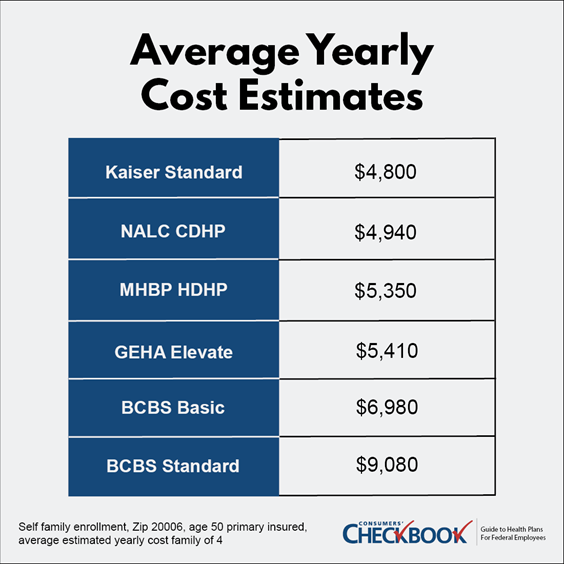

This year's FEHB open season runs from Nov. 14 to Dec. 12. If you're enrolled in FEHB, whether you're actively employed or retired, take advantage of this annual event to reevaluate your health care coverage to be sure you're in a plan that is both cost-effective and comprehensive. OPM reminds everyone that unexpected accidents and illnesses can be expensive. Even routine doctor visits and prescriptions can add up.

Thank you to all the veterans who have served our nation—and in some cases continue to serve as civilian federal employees. Do yourself and your family a favor by learning about your insurance benefits so you can continue to protect yourself and your loved ones.

Groups.io Links:

You receive all messages sent to this group.

View/Reply Online (#3442) | Reply To Group | Reply To Sender | Mute This Topic | New Topic

Your Subscription | Contact Group Owner | Unsubscribe [prefander.leadersworkshop@blogger.com]

![[TSPStrategy] Health Insurance Options for Veterans [TSPStrategy] Health Insurance Options for Veterans](http://2.bp.blogspot.com/-erTXCq61ULM/TmHYAQBZ0GI/AAAAAAAACCs/6cBX54Dn6Gs/s110-c/default.png)