Why federal workers should consider an HSA

COMMENTARY | There is something exciting about having a health insurance plan that can reduce your taxes while also providing tax-free investment growth.

With open enrollment less than a month away and the average premium increase at 13.5%, millions of federal employees are reevaluating their health insurance plans. While health insurance may not be the most exhilarating topic, there is something exciting about having a health insurance plan that can reduce your taxes while also providing tax-free investment growth. These are two benefits of a Health Savings Account, which according to the Consumer Financial Protection Bureau have surged in popularity, with the number of accounts increasing over 500% since 2013.

What's the Big Deal?

Selecting a High Deductible Health Plan with an HSA feature provides: (1) Generally less expensive bi-weekly premiums, (2) part of your bi-weekly premium is returned to you, (3) HSA contributions are pre-tax (reducing your taxable income), (4) HSA contributions made via payroll deduction are not subject to payroll tax, (5) you can invest your contributions in a variety of investments, (6) your money grows tax-free, (7) the HSA is yours and is completely portable – you keep it even if you leave the government or change to a health plan that's not HSA eligible, (8) no "use or lose" like with an FSA, (9) no income restrictions to contribute, (10) no Required Minimum Distributions, (11) HSA distributions are tax and penalty-free if used for qualified medical expenses (there are a lot of expenses that qualify), (12) distributions are tax and penalty-free to reimburse yourself for medical expenses that were paid out-of-pocket at any time after you established your HSA, and (13) once you reach age 65, distributions are penalty-free even if not used for qualified medical expenses (however, ordinary income tax will apply if for non-medical expenses).

HSA Eligibility

- Covered by a High Deductible Health Plan

- No other health insurance coverage

- Not enrolled in Medicare

- Can't be claimed as a dependent on someone else's tax return

Qualified Medical Expenses

Don't think of just traditional healthcare/medical expenses. Qualified expenses include a wide variety of items to include cold medicine, pain reliever, sleep aids, allergy medication, over-the-counter drugs, certain skincare products, heartburn tablets, band-aids, sunscreen, contraceptives, prescriptions, after-sun aloe, etc. For a full list of qualified medical expenses see IRS Publication 521 or visit HSA Store. If you have a family plan, expenses incurred for you, your spouse, and dependents are all eligible.

How Does This Work? My Real-Life 2024 Example.

(1) I was covered by the FEHB Plan #341 (GEHA HDHP)

(2) I paid bi-weekly health insurance premiums of $71.45

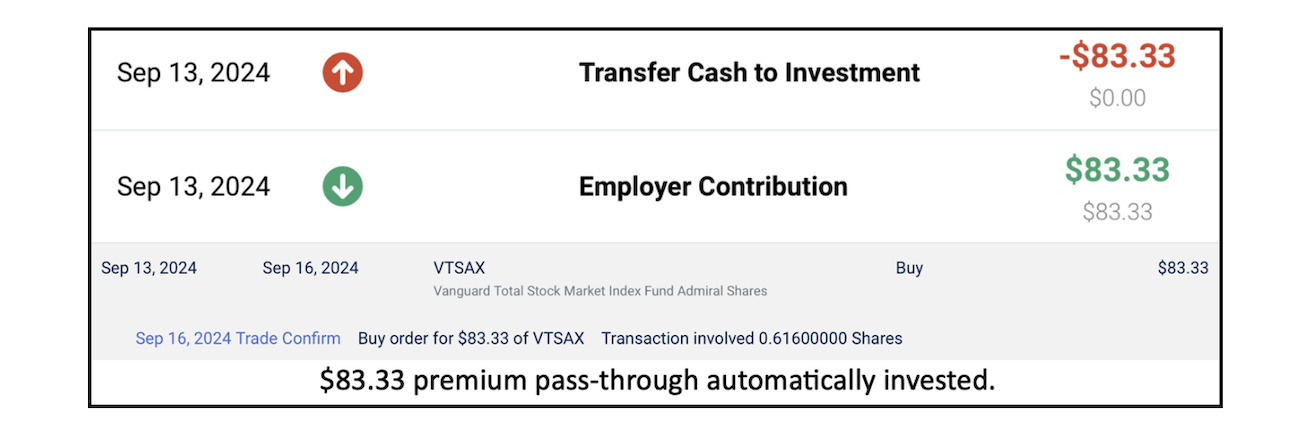

(3) Every month I received a deposit of $83.33 in my HSA account. This amount represents the $1,000 (self-only) premium pass-through (PPT) feature where a portion of your premium is returned. PPT in 2025 for self-only will remain $1,000 and for family plans will be $2,000.

(4) Since the total 2024 HSA contribution limit was $4,150 for self-only, and the $1,000 PPT counts towards the IRS limit, I contributed the remaining allowable amount ($3,150) from my paycheck throughout the year. This $3,150 of personal contributions was not subject to payroll tax and it reduced my taxable income. Contributions went straight from my paycheck to the custodian, HSA Bank. Note: Your personal contributions can go to any HSA custodian, or be rolled over from HSA Bank to a different custodian (Fidelity, Lively, etc.), but with the FEHB GEHA plan, the $1,000/$2,000 PPT will always be sent to HSA Bank.

(5) When the $83.33 PPT and my personal contributions hit my HSA Bank account, they automatically get invested in a low-cost passive index fund (not an investment recommendation). This money is now invested and will grow tax-free, similar to a Roth IRA, but better since those are pre-tax dollars going in. Note: you don't have to invest your HSA money, you could leave the HSA dollars in cash and use your HSA debit card to pay for qualified medical expenses.

(6) When I had medical expenses, I paid OOP, recorded it on a spreadsheet, and saved a picture of the receipt in a cloud folder. I can reimburse myself for these expenses at any time, even if it's 20-years from now and I'm no longer a government employee and not covered by an HSA eligible plan. The HSA money is mine to use for medical expenses, reimburse myself for expenses paid OOP, or use for anything after age 65 without penalty.

I view my HSA as a quasi-retirement fund, specifically aimed at handling medical expenses, Medicare Part B premiums, and/or long-term care. In extreme cases, it could even act as an emergency fund since I can technically withdraw money tax and penalty-free for all of the documented OOP medical expenses I've paid since I was first covered in 2020.

How Much Can You Invest in 2025

$4,300 for self-only plans and $8,550 for family plans. Individuals who will turn 55 in calendar year 2025 can contribute an additional $1,000 catch-up. For spouses with family coverage, each spouse can contribute an additional $1,000 to their individual HSA account. Remember, these contribution amounts are reduced by the PPT.

There is a unique situation where an adult child, not claimed as a dependent, but covered under their parent's family HDHP could also contribute $8,300 to their own HSA. For example, your 25-year-old child lives on their own, files their own return as a single filer, provides more than half of their own support, but is still covered by your HDHP family plan (allowable until age 26 under the Affordable Care Act). While the parent's HSA cannot be used to pay for the child's expenses, this child could open their own HSA and fund it with the full $8,300 family contribution amount, completely separate from the parents HSA. An important note, if your child could be claimed as a qualifying child dependent, but you choose not to claim them, they are not eligible for this HSA opportunity. The key is that they are not eligible, it's not enough to simply not claim them. For more details on what counts as a qualifying child consult IRS Publication 501.

Tax Savings (hypothetical with 2024 numbers)

Tax filing status: Married Filing Joint

Combined Income: $180,000

Standard Deduction: $29,200

Taxable Income: $150,800

State Tax: 5.75%

HSA Contributions via Payroll Deduction: $6,300

Federal Tax Savings: $1,386

State Tax Savings: $362

Payroll Tax Savings: $481

Total Tax Savings = $2,229

Compounding Magic – Just 5-Years Can Be Powerful

You and your spouse contribute and invest $6,300 ($242 per pay period) plus the $2,000 PPT ($166/mo.) every year for 5-years. We'll assume a 7% annualized growth and that the IRS contribution limit doesn't change. After 5-years, you'd have about $49,000. $31,500 came from your contributions, $10,000 from PPT, and the rest from growth. What could this turn into for a new employee and one approaching retirement?

Scenario 1: You're a 30-year-old new employee and life hasn't become too complicated yet. You don't have the new house, a bunch of kids running around, broken arms, braces, college costs, etc. You decide you're going to take advantage of the HSA for just 5-years. You leave it alone and don't touch it until it's time to pay for Medicare Part B premiums 30-years later. With a 7% annualized growth rate and no additional contributions, your $49,000 from age 35-65 has grown to $373,000. Obviously, inflation will make this worth less, but even with a 3% inflation rate, your $31,500 contribution would be worth about $153,000. Don't forget the $11,100 in tax savings from the 5-years you contributed (using the scenario above).

Scenario 2: You're a 45-year-old Foreign Service Officer or Special Category Employee approaching retirement at age 50. Life has become simple as an empty nester. You and your spouse are still relatively healthy, minus a few creaking knees and popping shoulders. You have the cash flow and want to try this HSA thing out for 5-years. With a 7% annualized growth rate and no additional contributions, your $49,000 from age 50-65 has grown to $135,000, factor in 3% inflation and it would be worth roughly $87,000, on top of the $11,100 tax savings (using the scenario above).

HSA Bank's New HSA Invest Program

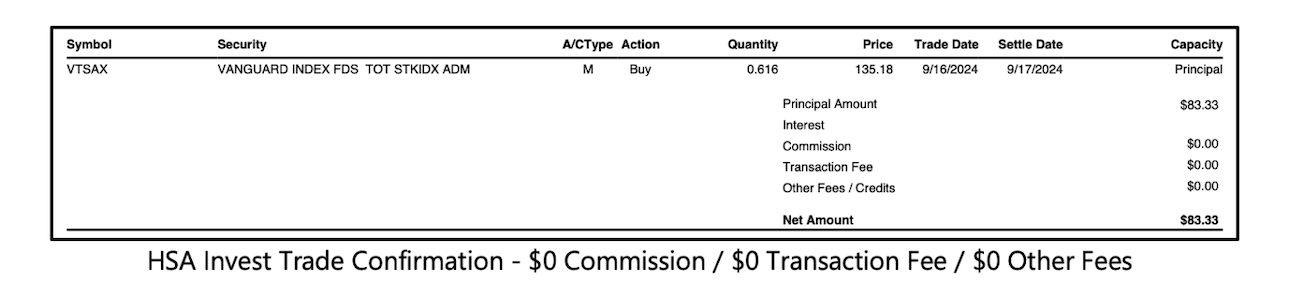

During my first four years with HSA Bank, I transferred my contributions and the PPT to Charles Schwab in order to invest the money. As of this year, HSA Bank is no longer allowing this. Instead, they've created their own investment platform called "HSA Invest". This is essentially a brokerage account built directly into the HSA Bank platform. At first, it was advertised that everyone would pay annual fees just for having an account (not very popular obviously). However, in September 2024, HSA Bank sent an email clarifying the fee structure for HSA Invest.

For those who are comfortable picking their own investments, there is a "Choice" option which costs GEHA members 0.00% fee. If you want guidance and a recommended list of funds to invest in, you can use the "Select" option which costs 0.25% annually. Finally, if you want your investments managed by an investment advisory firm, you can pay 0.35% annually with the "Managed" option. If someone has a "Managed" or "Select" account with a cash balance of $7,500 or more, the fees will be waived for that quarter.

I understand that people are upset about HSA Invest and don't like being told where to keep their money. Despite the backlash that's come from the federal employee community, from what I've seen, HSA Invest is not the villain many have made it out to be. I've been using HSA Invest since the rollout and have had no issues. I transferred my money back from Charles Schwab to HSA Bank, enrolled in HSA Invest, selected the one mutual fund I want to invest in, and set up automatic investing for every contribution and PPT deposit. Having HSA Invest versus Charles Schwab results in one less log-in for me to keep track of, keeps my financial life simple, and has cost me $0.

If things change with the HSA Invest platform or if they start to charge fees for the "Choice" option, I'll create an HSA account at a different custodian and move my money there. Remember, even in this scenario, the PPT would go to HSA Bank and I'd have to transfer it over.

If you are unhappy with HSA Invest and plan to move funds from HSA Bank to a new custodian there are two ways to do this. A direct trustee-to-trustee transfer, where the funds move directly from HSA Bank to your new custodian. Or, you can do a 60-day rollover where a check is sent to you first. Be careful with the 60-day rollover option. If the money is not deposited in the new HSA account within the 60-day window, the IRS will view this as a withdrawal and you could be on the hook for tax and 20% penalty. Also, you are limited to one 60-day rollover per 12-month period (not calendar year).

Premiums

Here are the 2025 premiums for GEHA HDHP vs. two popular Blue Cross Blue Shield plans that I also consider annually.

GEHA HDHP Self-Only (341): 2025 bi-weekly premium $76.27 ($1,983 annual) – an increase of $4.82

GEHA HDHP Family (342): 2025 bi-weekly premium $201.52 ($5,239 annual) – an increase of $12.74

BCBS Basic Self-Only (111): 2025 bi-weekly premium $113.16 ($2,942 annual) – an increase of $17.42

BCBS Basic Family (112): 2025 bi-weekly premium $303.61 ($7,893) – an increase of $41.01

BCBS Standard Self-Only (104): 2025 bi-weekly premium $174.81 ($4,545 annual) – an increase of $24.02

BCBS Standard Family (105): 2025 bi-weekly premium $424.65 ($11,040 annual) – an increase of $53.97

With the PPT factored in, a self-only plan's net annual premium in 2025 will be $983 and the net annual premium for a family plan will be $3,239. As federal employees, we pay roughly 25% of our total insurance cost. Here are the numbers for GEHA HDHP: $76.27 (employee bi-weekly premium) / $305.10 (total employee + employer bi-weekly premium) = 25% paid by the employee.

High-Deductible Sounds Expensive

If your goal is to have the absolute least amount of OOP expense, an HDHP is probably not the right fit. Everyone's health situation and medical needs are different. Even someone in great health may not want to roll the dice on the possibility of paying OOP regardless of the lower premiums, tax savings, and investment feature. However, make sure you do your homework using the OPM FEHB plan comparison site. There are other plans that aren't labeled HDHP and still have deductibles of $600/$1,200. Once you factor in the HDHP's $1,000/$2,000 PPT plus lower bi-weekly premiums, your regular plan could cost you more on a net basis than the HDHP.

How Much Could it Cost?

First and foremost, I want to stress the preventative care aspect. Things like annual physical exams, routine screenings, immunizations, two dental cleanings, etc. are generally covered by insurance before hitting your deductible, without any cost sharing, coinsurance, or copays. So, you should not be skipping your annual physical or dental cleanings because you're scared to see the bill.

Deductible – Just like with car insurance, the deductible is the amount you pay OOP before plan benefits begin. The GEHA HDHP 2025 in-network deductible is $1,650 for self-only and $3,300 for self plus one and family coverage.

Coinsurance – Coinsurance kicks in after you've met your deductible. Primary care office visits, labs, x-rays, emergency room visits, and specialists have a 5% coinsurance if in-network. If you visit the doctor's office and they bill $100, but the in-network provider has an agreement with GEHA to accept $80 as the allowable amount, you'll pay $80 if you haven't met your deductible yet. This $80 will be applied towards your annual deductible. If you have met your annual deductible ($1,650/$3,300) and the coinsurance is 5% of the allowable amount, you would pay $4.

Maximum Out-of-Pocket/Catastrophic Protection – This is the maximum you'll pay for coinsurance, co-pays, and deductibles (medical care and prescriptions) combined before insurance pays 100% of covered services. The in-network 2025 OOP maximum is $6,000 for self-only and $12,000 for family coverage. Out of network is $8,500 and $17,000. Remember, this catastrophic limit is for coinsurance, co-pays, and deductibles combined. Insurance will still kick-in once you reach your annual $1,650/$3,300 deductible.

What If I Withdraw HSA Money Before Age 65 for Non-Medical Purposes?

You'll pay ordinary income tax and a 20% penalty.

What If I Don't Want to Invest the Money?

You can still save by paying for medical expenses with pre-tax dollars. If you pay for a medical expense with $50 from your bank account, and you're in the 24% tax bracket, that actually cost you about $65 because you had to earn $65, pay 24% tax, and then net $50 in your bank account. If instead you pay $50 for something with $50 of pre-tax HSA money, it actually cost you $50.

What If I'm Not Healthy?

Electing to have an HDHP is a very personal decision. I don't know your financial or health situation, so nothing in this article should be seen as advice, simply a suggestion to consider.

An HDHP may be optimal for individuals with: (1) no healthcare needs, or (2) a lot of healthcare needs. Why those with a lot? Because most traditional insurances won't exclude co-pays and drug costs after hitting the annual catastrophic limit. This means that with a traditional plan, you could pay your catastrophic limit and still be on the hook for co-pays and prescriptions. On the other hand, OPM states that, "With an HDHP, once you hit the catastrophic limit, there is no out-of-pocket expense for covered in-network services."

What If I'm Too Healthy?

Congrats for winning the human biology lottery! However, it's still unlikely that you'll never have medical expenses. You can always reimburse yourself at any time in the future for those every day qualified medical expenses.

HSA funds can also be used to pay for Medicare Part B and Part D premiums and long-term care (LTC) insurance premiums. The odds are good that sometime before you die, you'll have some medical expenses that could be paid with tax-free money that compounded for decades. Worse-case scenario you're super human and this account morphs into an account that's very similar to a Traditional IRA or pre-tax 401(k) at age 65. You'll pay income tax but no penalty.

Downsides

(1) California & NJ don't recognize the HSA and your contributions won't reduce your state income tax. Dividends, interest, and capital gains are also taxable at the state level. You'll still reap the federal tax benefits.

(2) If you die, your spouse can inherit your HSA as if it was their own. If they die, or if you have a primary non-spouse beneficiary, the account is no longer classified as an HSA when you die. When this happens, the fair market value of the account becomes taxable to the beneficiary in the year in which you die. This could create a tax issue for non-spouse beneficiaries. There are ways to plan around this issue and you should consult a financial professional if it's a concern.

Reporting

There's no heavy lifting at tax time. You'll receive a 5498-SA from your HSA custodian showing how much you contributed. A 1099-SA will be issued if you took distributions from your account. At tax time you'll need to file IRS Form 8889 documenting your contributions, your employer's contributions, any distributions taken, and any penalties owed. You don't have to provide receipts at tax time showing that you paid for qualified medical expenses, however, you'll still want to save the receipts and have a good tracking system in place in the event of an audit.

Tyler Weerden, CFE is a financial planner and the owner of Layered Financial, a Registered Investment Advisory firm located in Arlington, Va. In addition to being a financial planner, Tyler is a full-time federal agent with 15 years of law enforcement experience on the local, state, and federal level. He has served in both domestic and overseas Foreign Service assignments.

Groups.io Links:

You receive all messages sent to this group.

View/Reply Online (#3809) | Reply To Group | Reply To Sender | Mute This Topic | New Topic

Your Subscription | Contact Group Owner | Unsubscribe [prefander.leadersworkshop@blogger.com]

![[TSPStrategy] Why federal workers should consider an HSA [TSPStrategy] Why federal workers should consider an HSA](http://2.bp.blogspot.com/-erTXCq61ULM/TmHYAQBZ0GI/AAAAAAAACCs/6cBX54Dn6Gs/s110-c/default.png)