As you prepare to leave federal service, here are some important things you must do:

- Make sure the TSP has your current address at all times.

- If you have any TSP loans, decide if you want to pay them off, keep them open and set up monthly payments, or allow them to be foreclosed and accept the outstanding balance and accrued interest as taxable income.

- Read the TSP booklets Distributions and Tax Rules about TSP Payments to fully understand your options and their consequences.

TSP Tax Information

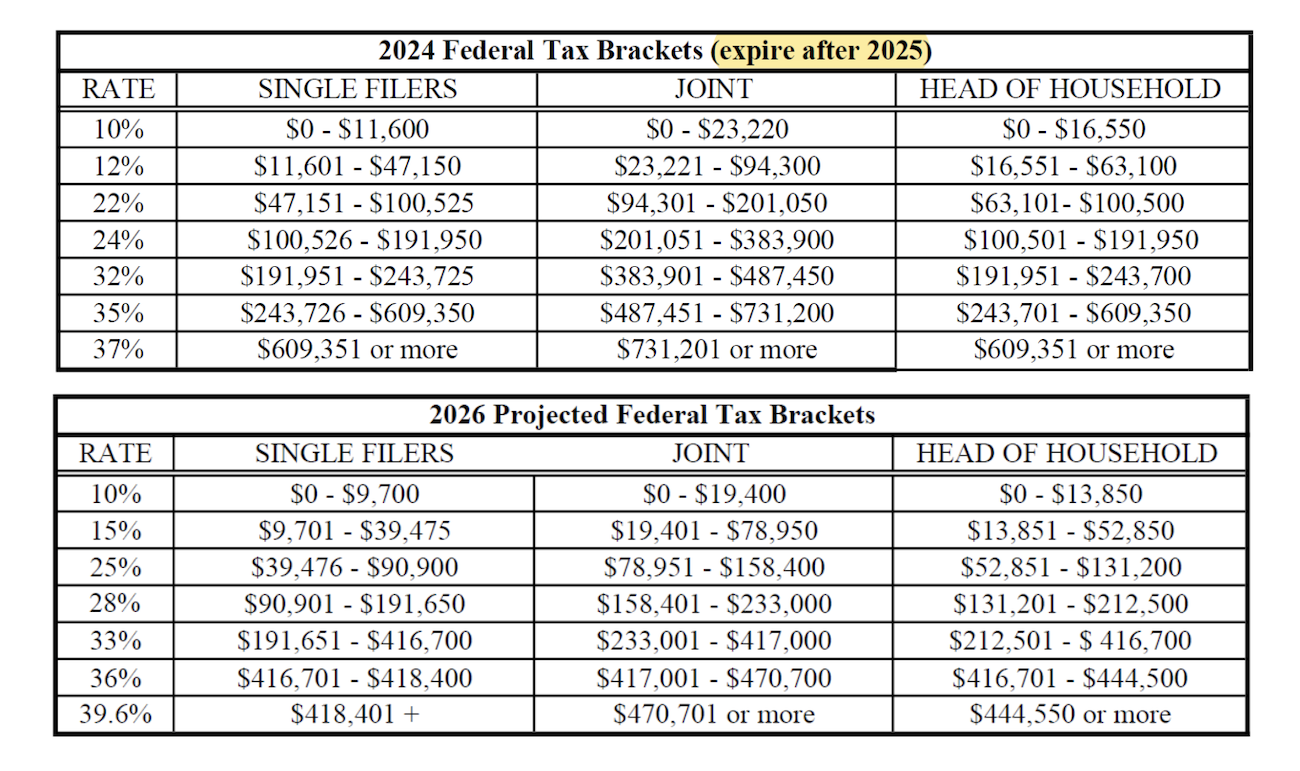

You've saved for your retirement and plan to use these savings to make life after retirement financially comfortable which also involves careful tax planning so that you can keep more of the money that you've accumulated. TSP contributions fall into two categories for income tax purposes: pre-tax and post-tax. Pre-tax contributions are considered "traditional" and post-tax contributions are "Roth." Traditional TSP contributions grow tax-deferred which means when you elect to withdraw your funds, the entire amount will be subject to income tax, including the earnings. According to AARP, these eight states don't tax income at all: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. New Hampshire, only taxes capital gains and dividend income. And Alabama, Illinois, Iowa, Hawaii, Mississippi and Pennsylvania exclude pension income from state taxes.

Roth TSP contributions grow tax-free, however, there are certain requirements that must be met to make tax-free withdrawals that include the earnings. For a distribution to be qualified, you must be 59 1/2 or older, permanently disabled, or deceased, and five years must have passed since your first Roth contribution. For important tax information, see TSP Publication 26. Be careful if you separate prior to the year you reach age 55. TSP withdrawals may be subject to a 10% early withdrawal penalty on top of the income tax due on your withdrawal. If you rollover or transfer your funds to an IRA, you may need to wait until age 59 1/2 to take a penalty-free withdrawal. See page 3 of TSP Publication 26 for all of the exceptions to the 10% early withdrawal penalty tax.

Social Security and the FERS Special Retirement Supplement

Reduced Social Security retirement benefits are payable starting at age 62 and can be delayed until age 70 to earn delayed retirement credits. Considerations for choosing the starting date for Social Security retirement may be influenced by the age when you stop earning substantial income and whether it is more important to have a smaller benefit for more years or a larger benefit for fewer years, after all, the end date will be the same. According to the Social Security Administration, the major source of income for most people over age 65 is Social Security. Nearly nine out of 10 people ages 65 and older were receiving a Social Security benefit as of June 30, 2023. Social Security benefits represent about 30% of the income of people older than 65. Among Social Security beneficiaries aged 65 and older, 37% of men and 42% of women receive 50% or more of their income from Social Security. Among Social Security beneficiaries aged 65 and older, 12% of men and 15% of women rely on Social Security for 90% or more of their income. Federal retirees have the advantage of an additional stream of lifetime retirement income from CSRS or FERS retirement benefits. Additionally, many federal retirees have substantial savings in the TSP to allow additional flexibility in claiming Social Security retirement benefits. To learn more about your Social Security benefits, visit Social Security Administration's website

Many federal employees are eligible to retire before they qualify for Social Security retirement benefits. To bridge the gap between retirement and age 62, a FERS retiree may be entitled to a Special Retirement Supplement. Federal employees who file for an immediate unreduced retirement at their Minimum Retirement Age with 30 or more years of service or at age 60 with 20 or more years are eligible for a Special Retirement Supplement. Also those who retire under the special provisions for law enforcement, firefighters and air traffic controllers are also entitled to this benefit. The supplement ends at age 62 and is subject to an earnings test which can reduce or terminate the benefit sooner than age 62. If you want Social Security retirement to begin at age 62, you must file for benefits up to four months before you want your benefit to begin.

FERS Vesting

It takes five years of creditable civilian federal service covered under FERS to be vested for a FERS Basic Retirement Benefit. Depending on your age when you separate from federal service, this may be a benefit payable immediately or you may be entitled to a deferred retirement at a later age. Survivor benefits for eligible family members are payable once you have completed 18 months of creditable civilian employment. Disability retirement benefits for employees who have a condition that will prevent them from performing their job duties for at least a year or who have a permanent disabling condition may be available after 18 months of civilian service upon approval from the Office of Personnel Management.

Immediate Optional Retirement: FERS

An immediate, unreduced retirement benefit under FERS is payable at the MRA, which is age 57 if you were born in 1970 or later, if you have performed at least 30 years of creditable service. If you are 60, you only need to have 20 years to avoid an age reduction. At age 62, the minimum service requirement is 5 years for an unreduced immediate annuity. For most employees, the benefit is computed at 1% x your high-three average salary (the highest average basic pay over any three consecutive years of service) x years / months of creditable service. The factor changes to 1.1% for employees retiring at age 62 with 20 or more years of service credit.

Be sure to meet with your benefits office at least 60 days before your chosen date of separation to receive a retirement estimate and additional information you will need to transition to retirement. Your agency personnel and payroll office will start processing your case after your official date of separation for retirement.

To begin the retirement process, complete Form SF 3107, FERS Application for Immediate Retirement (SF 2801 for CSRS and CSRS Offset). The completed form should be submitted to your benefits office at least 60 to 90 days prior to your planned retirement date. To learn more about processing an immediate retirement, see OPM's Quick Guide to Processing Retirement. Be sure to keep copies of your signed application and if possible, keep a copy of your personnel file (Official Personal Folder or electronic Official Personnel Folder). If you require assistance after retirement, contact OPM at 888-767-6738 and have your claim number ready. Your Civil Service Active number that identifies you as an "annuitant" is provided to you approximately six weeks following your retirement.

Deferred Retirement: FERS

A deferred retirement is payable at age 62 if you have completed at least five years of creditable civilian service before you left federal employment. You would also be eligible for a deferred retirement at your FERS MRA if you have completed at least 10 years of creditable service (five years must be civilian service) and you left federal service before reaching your MRA. Your annuity will be reduced by 5/12 of 1% for each full month (5% per year) that the beginning date of your retirement precedes your 62nd birthday.

To avoid a reduction for age, it is very important to choose to have your annuity begin on the first day of the month following the month in which you reach your MRA if you left federal service with 30 or more years of service. If left with 20 to 30 years of service choose the first day of the month after your 60th birthday. A deferred retirement can begin on the first day of any month which is at least 31 days after OPM receives your application for retirement if you have reached your MRA but before your 62nd birthday. If you separated with less than 20 years of service (and more than 5 years), you can avoid the age reduction altogether if you choose the first day of the month that you reach age 62 as your annuity beginning date. Complete application RI 92-19 to apply for a deferred retirement.

Example 1: Mandy left federal service with 20 years of creditable service at age 46. Her birthday is June 15. To avoid the age reduction, she will file an application for deferred retirement about 60 days before she reaches age 60 and will elect for her annuity to begin on July 1st of the year she turns 60.

Example 2: Matthew left federal service at age 38 with 12 years of creditable service. His birthday is November 20. He must wait until age 62 to apply for an unreduced deferred retirement benefit. He should elect for his retirement to commence on November 1 of the year he turns 62.

Postponed Immediate MRA + 10 Retirement: FERS

If you leave federal service after attaining your MRA and you have completed at least 10 years of creditable service, you are eligible for an immediate retirement and may be eligible to continue your insurance benefits into retirement (FEHB, FEGLI, and FEDVIP). It is extremely important to choose the correct beginning date for your retirement if you wish to maintain these benefits. If you choose to postpone filing your application to avoid the age reduction, your annuity must begin the first day of the month that you reach age 62 or the first day of the month after your 60th birthday if you had at least 20 years of service at your separation from federal employment. If you are willing to accept the age penalty, you may elect to have your annuity commence the first day of any month following your resignation or on the first day of any month which is at least 31 days after OPM receives your application but before your 62nd birthday. If your annuity commences after your 62nd birthday, you WILL NOT BE ELIGIBLE TO REINSTATE YOUR INSURANCE COVERAGE and you will be considered retired under a deferred annuity. Complete application RI 92-19 to apply for a postponed MRA + 10 retirement.

Example 1: Cecil left federal service at age 57 with 22 years of federal service. His birthday is March 18. He will file his application for a postponed MRA + 10 retirement about 60 days before he turns 60 and elect for his annuity to begin on April 1.

Example 2: Margaret left federal service at age 58 with 19 years of service. Her birthday is September 29. She will apply for her retirement about 60 days before her 62nd birthday and will elect for her retirement to begin on September 1 (before her 62nd birthday).

Continuation of Federal Employees Health Benefits (FEHB)

As long as you participated in the FEHB program for the five years of service immediately preceding your last day of federal employment (or continually from your earliest opportunity), you may continue coverage if you are eligible for an immediate unreduced retirement or an MRA + 10 retirement if you separated from federal employment at your MRA or later with at least 10 years of service. See the above requirements for reinstating your insurance if you choose to postpone your immediate MRA + 10 annuity. For more details on continuation of FEHB in retirement see the FEHB Handbook. When you postpone your MRA + 10 retirement application, you will also postpone your FEHB coverage until it is reinstated when your FERS annuity begins.

Continuation of Federal Employees Group Life Insurance (FEGLI)

As long as you participated in the FEGLI program for the five years of service immediately preceding your last day of federal employment (or continually from your earliest opportunity), you may continue coverage that was in effect for the last five years of your career if you are eligible for an immediate unreduced retirement or an MRA + 10 retirement if you separated from federal employment at your MRA or later with at least 10 years of service. See the above requirements for reinstating your insurance if you choose to postpone your immediate MRA + 10 annuity. For more information on continuation of FEGLI in retirement see the FEGLI Handbook pages 114 - 131. When you postpone your MRA + 10 retirement application, you will also postpone your FEGLI coverage until it is reinstated when your FERS annuity begins.

Federal employees Dental and Vision Insurance Program (FEDVIP)

If you were enrolled in FEDVIP when you left federal service and you had 10 or more years of service and separated at your MRA or later, you are eligible to reenroll in FEDVIP. When you postpone your MRA + 10 retirement application, you will also postpone your FEDVIP coverage until your FERS annuity begins.

Federal Employees Long Term Care Insurance Program (FLTCIP)

If you leave government employment, you can keep your coverage as long as you continue to pay the required premium and have not exhausted your maximum lifetime benefit. OPM suspended applications for coverage under the FLTCIP to allow OPM and the FLTCIP carrier, John Hancock Life & Health Insurance Company, the time to thoroughly assess benefit offerings and establish sustainable premium rates that reasonably and equitably reflect the cost of the benefits provided, as required under 5 U.S.C. 9003(b)(2). For additional information about FLTCIP premiums, you may visit LTCFEDS.com/about-premiums.

To learn more about your federal retirement and insurance benefits, visit:

OPM Insurance or OPM Retirement Center.